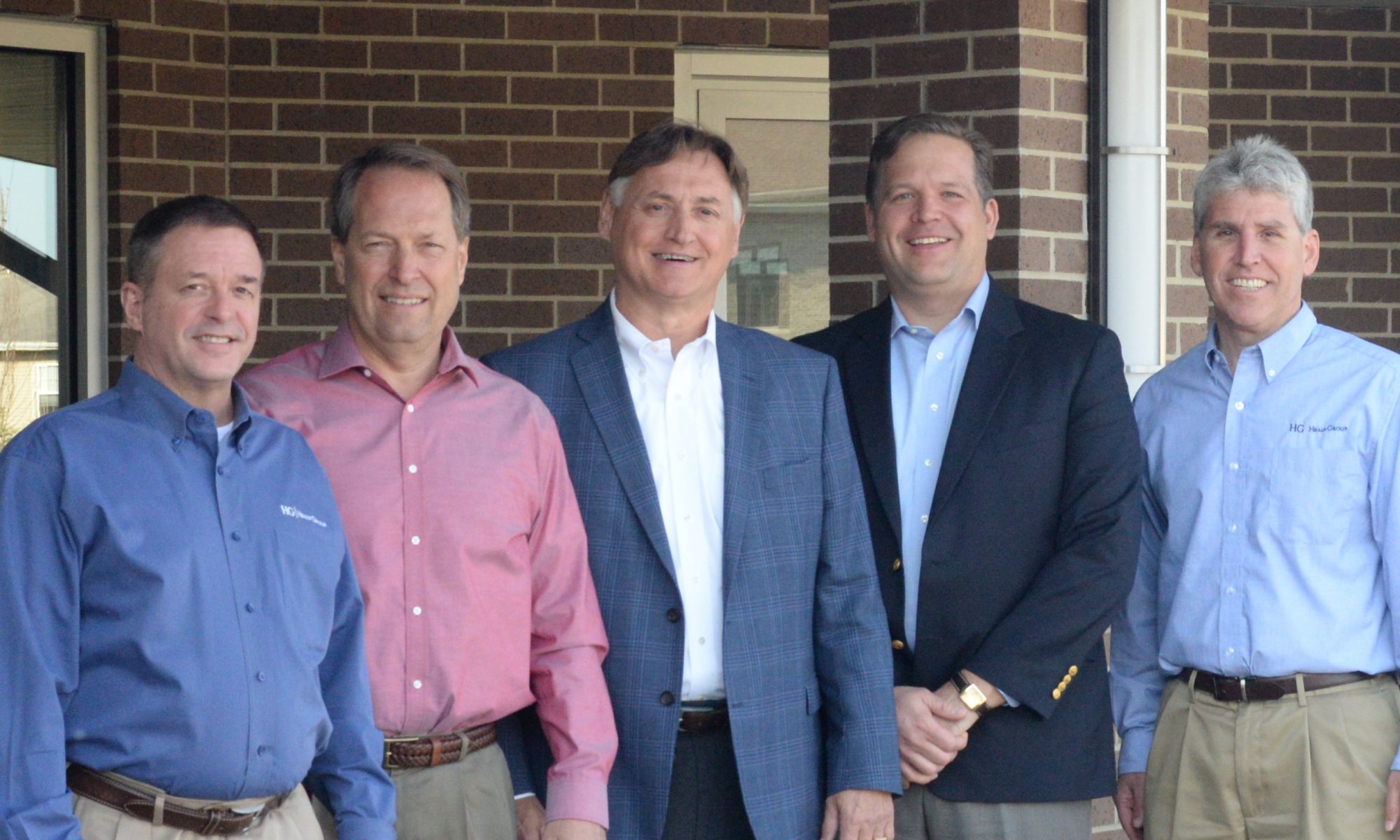

Healy Group owners (from left) Tony Nyers, Rich Preuss, Chris Rowland, Matt Urbanski and Randy Raciti.

Healy Group owners (from left) Tony Nyers, Rich Preuss, Chris Rowland, Matt Urbanski and Randy Raciti.by Sean Connolly

Photos: Christin Rose, Margaret Anderson

With this article, which tells the stories of Rich Preuss, Randy Raciti, Chris Rowland and Matt Urbanski (all South Bend), four of the owners of Healy Group, we are beginning a series on entrepreneurs in the community. If you have a suggestion for a future story in this series please contact us at thevine@peopleofpraise.org.

"You can be the best financial advisor in the world, but if you don’t have a client it doesn’t matter. You’ll starve to death.”

Rich Preuss, a financial advisor and an owner of Healy Group in South Bend, is telling me about the days when he cut his teeth as a salesman. In 1982, Rich was a young man with a master’s degree in theology who wanted to become a stockbroker. After Merrill Lynch rejected him, Ed Healy, a life insurance agent, offered Rich a job. (Rich went on to marry Ed’s daughter Beth, though Ed didn’t know about their budding relationship when he hired Rich.)

The job involved lots of cold calling. “Ed gave me these 3x5 Dun & Bradstreet cards, which listed a business, its owner, and the sales of the company, and he said, ‘Call these people.’”

He aimed to make 50 calls each week. On the phone, he would ask for a face-to-face meeting. If he got a yes, he’d bring along an experienced salesman and listen to the pitch, studying points of tension and connection.

“Trying to get new clients is brutal, psychologically,” he says. “When I started out I probably thought about quitting every day for the first five years.”

He put his hope in a formula—if he made 10 calls, he could get two or three meetings and land one client. It was the spirit of Babe Ruth, the baseball legend, who set the record for home runs while simultaneously setting the record for strikeouts.

“So much of building a business and getting clients comes down to what you do each day,” he says. “It’s a matter of calling people and doing the little things. As the saying goes, when you do the little things, the big things take care of themselves.”

***

Built on the little things, Healy Group is much larger today than it was in the 1980s—with 41 employees spread across four divisions. The life insurance work that Rich began with morphed into a broader financial planning division, employing Rich, Randy Raciti and Matt Urbanski, plus community members Christin Rose, Joe Cramer, Linda Mooney and Claire Mysliwiec, and five other employees.

Chris Rowland leads a separate division with 12 employees focused on employee benefits. Another community member, Tim Pingel, works in the insurance division. The mortgage division is led by Mike Morin, a Trinity School at Greenlawn parent.

Growth did not come fast, but it has accelerated recently. “It took us 23 years to get to 10 employees,” says Randy, Healy Group’s president, noting that in 2015 the company added 10 employees in a single year. In 2014 they moved into their new 12,000-square-foot office building, which they designed with extra space so that growth can continue.

***

Randy started at Healy in 1987. The son of a salesman and entrepreneur who died when Randy was 13, Randy always wanted to follow in his father’s footsteps as a businessman. But by 1987 his career had reached a turning point, so he took a walk with Joel Kibler (Vancouver-Portland). “I have this sense that you and Rich Preuss should be working together,” Joel told Randy, who applied for a job at Healy.

He started by selling employee benefits packages and helping individual clients with financial planning. Randy is a dogged worker—as a young man he would rise at 4:00 a.m. and work until midnight, then get up and do it all over again. He’s also a born salesman. “I am very comfortable picking up the phone and introducing myself,” he says.

In 1990 Randy entered a leadership program, and when the classes ended he contacted all 45 of his classmates. “Presidents of banks, presidents of hospitals, presidents of media companies— I contacted them all. I didn’t know any better. I was 29 years old, so why not?”

On the phone, he would offer to take his prospect out to breakfast or lunch. Then, over the meal, Randy would spend most of the time, perhaps 40 minutes, listening to his prospect’s story, waiting patiently until the final 10 minutes, when he would tell his own story and offer his services. He and Rich were both aggressive about adding new clients. “One year we had a little personal competition for how many new people we could meet with in the course of a year, and I think we both blew through the 200 new people mark,” Randy says.

Claire Mysliwiec enjoyed a Dairy Queen Dilly Bar provided by Tim Pingel, known for offering ice cream treats to his fellow employees.

Claire Mysliwiec enjoyed a Dairy Queen Dilly Bar provided by Tim Pingel, known for offering ice cream treats to his fellow employees.To help their clients, Randy and Rich began using a software program to forecast the amount clients needed to save for retirement. Most appointments were outside the office, so they would bring a 70- or 80-page printed report with scenarios and projections. Inevitably, the client would want to alter the variables—to see the impact of saving more or working longer— so the advisor had to return to the office and rerun the numbers. “That created frustration for us and for the client,” Rich says.

Over time the software improved, and Rich and Randy began meeting with clients at the Healy Group office, where they could run projections on the spot. They also started using a more comprehensive planning process, analyzing a client’s overall level of protection, debt, savings and investments. With a more complete picture, they noticed ways to save the client money. By 1999, Randy’s efforts had begun to blossom, and he wanted to go full-time as a financial planner.

Enter Chris Rowland.

***

Chris had been working in employee benefits since 1985, when he graduated from Notre Dame with his M.B.A. As an undergrad, he had majored in philosophy, but had developed an interest in business. In graduate school he first learned about the up-and-coming field of employee benefits. A young married man, he saw a chance to do good for people while also providing for his family. He worked for two different companies in South Bend before joining Healy in 1999 to take over, and eventually expand, Randy’s employee benefits portfolio. “The mindset that we’re helping build the kingdom of God when we take care of people, that we’ll go above and beyond the call of duty—that attracted me,” Chris says.

Employee benefits work has different rhythms from financial planning. Most of Chris’s clients are businesses—small companies, nonprofits and larger corporations. Chris and his staff of 12 act as middle men between the companies who sell group health, life and disability insurance packages and the companies providing insurance to their employees. They negotiate contracts, offer ideas and answer questions. Health insurance costs are always rising and regulations changing, so a lot of the work Chris and his team does is educational—teaching human resources departments about changes in the marketplace, teaching employees about changes to their plans. “We want to work hard for our clients to make sure problems are resolved and that they can afford to offer health insurance to their employees,” he says.

***

If phone calls and sales efforts are the skeleton of the business, then faceto-face client meetings are the heart and soul. They are where the music happens, where “we take on our clients’ problems as if they’re our own problems,” as Chris puts it.

Even if the problem is a flat tire. Healy Group employees like to tell the story of a client who rolled into the parking lot on just three good tires. Tim Pingel spotted the flat, and in a meeting he and Rich were having with the client, Tim asked the client for his keys. He asked at least twice before the surprised client agreed. Tim went out to the parking lot, found the jack and spare, raised up the metal hulk, switched the tire, then lowered the minivan back down to the ground, while Rich finished meeting with the client.

Employees spiritedly entered into a Friday fun game: identifying fellow employees from their baby pictures.

Employees spiritedly entered into a Friday fun game: identifying fellow employees from their baby pictures.Matt Urbanski tells another story about driving to Bremen, Indiana, to visit an elderly couple he advises. On the way there, he remembered that the husband loves chocolates, so he decided to stop at a grocery store and buy some. Praying while he drove, he asked the Lord what he thought. Much to Matt’s surprise, the Lord prompted him to buy some paczkis instead. (Paczkis are a Polish pastry.) Matt showed up with the paczkis, only to learn that the wife had been hankering for some all day. In fact, when Matt had called earlier, she thought about asking him to bring some, but dismissed the idea as too trivial. Later, Matt prayed with the husband for arthritis in his hands and the wife for neck pain. Both told him they experienced relief after his prayer.

Matt is Healy’s newest owner. He started in 2000, but only after putting off the idea for several years. As a college student in the early 1990s, he met with Rich to ask his advice about whether to major in finance or marketing. “I don’t think it matters,” Rich told him, “because we’ll hire you whatever you major in.” Matt chose marketing, worked for a restaurant ownership group, then led the development office at Holy Cross College. By 2000 he was ready to try insurance sales and financial planning. He says his first year at Healy did not go well, at least by conventional measures. He worked harder than he ever had, but he brought in less income than he had in his previous job. (Several years later someone told him that 90 percent of financial advisors quit in their first year.) Matt persisted, developing a niche helping young families who wanted life insurance and whose incomes would grow over time, giving them more money to invest.

He can still recall two phone calls early in his career, when he learned that two of his clients, both husbands, had died in tragic accidents. Matt usually recommends that clients buy enough life insurance so that the payouts could replace the client’s income if the client were to die. Because these clients had followed Matt’s advice, Matt knew that the widows would not have to worry much about money.

***

Matt, Chris, Rich and Randy all talk about the importance of building trusting relationships—crucial when dealing with a subject as sensitive and as personal as money. Christin, a new certified financial planner who worked for many years as Rich’s assistant, has sat in on hundreds of client meetings. She says there’s no particular technique or sales strategy involved in building trust. “Rich is just really very genuine and very much himself. He cares about the client first and foremost.”

This kind of care flows from a question that both Rich and Randy ask all their clients: “What do you want?”

“The most important part of my job is spending time understanding the client,” Rich says. “Money is just a means to something. What do you want to do with your money? Do you want to educate your children? Retire? Give money to charity? One question I ask almost everybody is, ‘If you won $10 million in the lottery, what would you do?’ The answers tell me a lot about how the client thinks about money.”

Randy puts it like this: “You have to help people get what they want. ‘What do you want?’ ‘Where are you at?’ ‘How can we close the gap?’ It’s that simple. That’s the story that gets played out over and over again.”

It may be a simple tune, but humming it repeatedly seems to work. Over the years, Healy Group has helped many hundreds of clients and accomplished more besides, providing for the families of the employees and owners. The company has allowed Chris, Rich, Matt and Tim the freedom to serve as branch coordinators, taking phone calls during the workday if need be. It has created jobs for community members and locals in an environment marked by fun, friendship and service. There are birthday honorings, a chili cook-off, an annual trip to a South Bend Cubs baseball game, talks on right speech, service projects and plenty of prayer. “It’s a very positive environment,” says Linda. “People care. The leaders have a vision. Being in a Christian environment, your hope is not in your job, it’s in the Lord. I think that helps keep things in perspective.”

Regarding perspective, Randy recalls a conversation with Rich that began as a discussion of standard business metrics: revenue, profit and the growth of the company. Then Rich abruptly changed the topic. “I think we should just focus on what the Lord wants us to do with the relationships we have, and just continue to respond to the Holy Spirit and keep taking steps,” Rich said.

The owners do not want to grow just for growth’s sake, as Chris explains, but in a way that is organic, and in keeping with God’s desires for the company. Prayer is key. “We pray that the Lord sends us good people to work for us and helps us pick up good clients.”

“The story of Abraham serves as a good guide for us,” Randy says, for Abraham proved “faithful in small things” and became the father of many.